Insurance Deductibles Explained: How They Affect Your Coverage and Pocket

Navigating the world of insurance can often feel like learning a second language. Between premiums, out-of-pocket maximums, and co-pays, one term stands out as perhaps the most critical for your bank account: the insurance deductible. Understanding how deductibles work is essential for any consumer in the United States looking to balance affordable monthly costs with reliable financial protection.

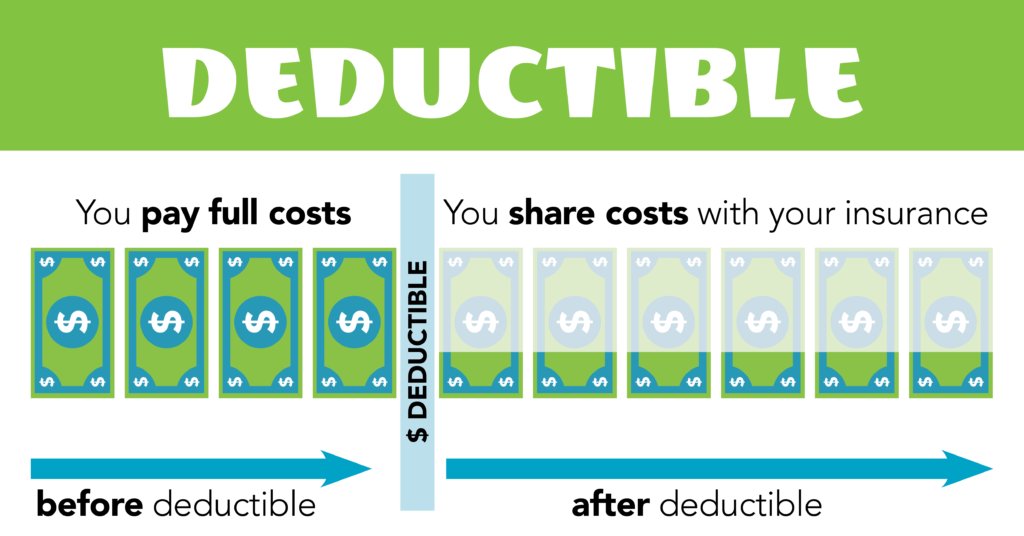

In simple terms, an insurance deductible is the amount of money you agree to pay out-of-pocket for covered expenses before your insurance company begins to pay for a claim. Whether you are looking at health, auto, or homeowners insurance, the deductible is a fundamental component of your policy’s structure.

How Does an Insurance Deductible Work?

When you sign up for an insurance policy, you choose a deductible amount. For example, if you have an auto insurance policy with a $500 deductible and you get into an accident that causes $2,000 in damages, you are responsible for the first $500. The insurance company then covers the remaining $1,500.

It is important to note that deductibles apply per claim in some types of insurance (like auto and home) and per year in others (like health insurance). This distinction is vital for your annual financial planning.

The Relationship Between Deductibles and Premiums

There is a direct, inverse relationship between your deductible and your premium (the monthly or annual fee you pay for the policy).

- High Deductible = Lower Premium: By taking on more financial risk yourself, the insurer rewards you with lower monthly payments.

- Low Deductible = Higher Premium: If you want the insurance company to cover almost everything from the start, you will pay a higher price every month for that peace of mind.

Types of Insurance Deductibles in the USA

1. Health Insurance Deductibles

In the U.S. healthcare system, the deductible is usually annual. You must reach this limit through doctor visits, prescriptions, or hospital stays before the insurer starts picking up the bill. However, under the Affordable Care Act (ACA), many preventative services—such as annual check-ups and certain screenings—are covered 100% by the insurer even before you meet your deductible.

2. Auto Insurance Deductibles

Auto deductibles typically apply to Collision and Comprehensive coverage. If your car is stolen or damaged in a storm, your deductible kicks in. Interestingly, Liability insurance (which covers damage you cause to others) usually does not have a deductible.

3. Homeowners Insurance Deductibles

Home insurance deductibles can be a flat dollar amount (e.g., $1,000) or a percentage of the home’s insured value. Percentage-based deductibles are common for specific perils like hurricanes or earthquakes. If your home is insured for $300,000 and you have a 2% hurricane deductible, you would have to pay $6,000 out-of-pocket before coverage begins.

High-Deductible Health Plans (HDHPs) and HSAs

In recent years, High-Deductible Health Plans (HDHPs) have become increasingly popular in the United States. To qualify as an HDHP in 2024/2025, the deductible must meet a certain threshold set by the IRS. The primary advantage of these plans is the eligibility to open a Health Savings Account (HSA).

An HSA allows you to set aside pre-tax money to pay for qualified medical expenses. This is a powerful tax-saving tool because the money goes in tax-free, grows tax-free, and comes out tax-free when used for healthcare. For many Americans, the combination of a lower premium and the long-term investment potential of an HSA makes high deductibles a smart financial move.

Common Misconceptions About Deductibles

«I have to pay the deductible for every doctor visit»

Actually, many plans use co-pays (a flat fee like $30) for office visits that apply regardless of whether your deductible has been met. Always check your Summary of Benefits to see which services are «subject to the deductible.»

«If the accident wasn’t my fault, I don’t pay a deductible»

In auto insurance, if someone hits you, you might still have to pay your deductible to get your car fixed quickly through your own insurer. Your company will then pursue the other driver’s insurance (a process called subrogation) to recover the money. If they are successful, they will reimburse your deductible.

How to Choose the Right Deductible Amount

Selecting the «right» number requires a candid look at your finances. Ask yourself these three questions:

- Do I have an emergency fund? If you have $2,000 in savings, a $1,000 deductible is manageable. If you have no savings, a high deductible could lead to debt in the event of an accident.

- How often do I use these services? If you visit the doctor frequently or have a long commute in heavy traffic, a lower deductible might save you more money in the long run.

- What is the «break-even» point? Calculate how much you save in premiums by raising your deductible. If raising your deductible from $500 to $1,000 saves you $50 a year, it would take ten years without an accident to justify the switch. If it saves you $250 a year, the «break-even» is only two years.

Conclusion: The Strategy of Risk Management

An insurance deductible is not just a cost; it is a tool for risk management. By understanding the specific rules of your policy—whether it’s the out-of-pocket maximum in health insurance or the percentage-based triggers in homeowners insurance—you can make informed decisions that protect both your assets and your monthly budget.

Always review your insurance policies annually. As your savings grow or your life situation changes, the deductible that made sense last year might not be the best fit today. Staying proactive ensures that you are never caught off guard by an unexpected bill, allowing you to navigate life’s uncertainties with financial confidence.